This system helps to eliminate business blind spots, using the strategic monthly board reporting process.

=-=-=-=-=-=

System Architect: Alan Miltz

Website: www.cashflowstory.com

Generated as part of the www.BusinessSystemsSummit.com

Step 1: Create a one-page monthly financial scorecard.

- The one-page financial record that contains 4 chapters.

- Chapter 1: Profitability – your profit.

- Chapter 2: Working Capital – equals = (Receivables + Inventory or Work in Progress) – Payables

- Chapter 3: Other Capital – your Balance Sheet.

- Funding (Net Debt + Equity) = Net Operating Assets (Working Capital + Other Capital).

- Funding (Net Debt + Equity) = Net Operating Assets (Working Capital + Other Capital).

- Chapter 4: Funding and Returns – your funding as measured by your cash flow.

- The quick way to calculate Chapter 4 is the movement in all your bank accounts – that’s the reconciliation of cash.

- The quick way to calculate Chapter 4 is the movement in all your bank accounts – that’s the reconciliation of cash.

- Further examples here.

- Chapter 1: Profitability – your profit.

Step 2: Calculate and include your marginal cash flow on your financial scorecard.

- Marginal cashflow calculation: Gross Margin % – Working Capital %

- Formula = (Gross Margin / Revenue) – [Working Capital (Debtors + Inventory / WIP + Creditors)/Revenue]

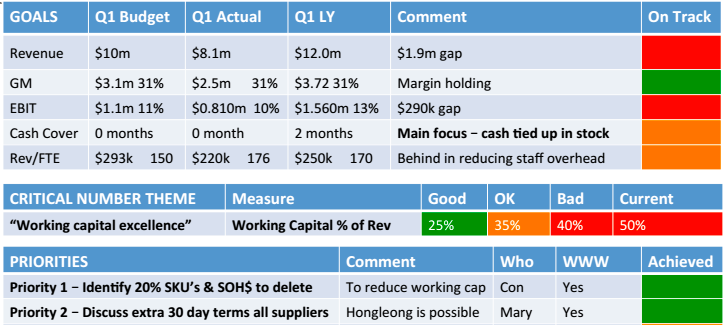

Step 3: Create visibility in your company.

- Create your Ideal profile/target for each measure in your Profitability and Working Capital.

- Colour code your business for each of the measures Good (Green) / Average (Yellow) / Bad (Red) for each of the business ratios.

Step 4: The financial health review process.

- Review your one-page scorecard and the colours (green, orange, red) that you are getting each month.

- Look at your trends in Working Capital

- Working Capital Timeline (Creditor Days, Stock Days, Debtor Days)

- Working Capital Timeline (Creditor Days, Stock Days, Debtor Days)

- Profitability trends (Gross Margin %, EBIT %, Net Profit %)

- Revenue Growth vs. Overheads Growth

- Look at your trends in Working Capital

Step 5: Define actions based on 7 levers to improve business.

- On a quarterly basis discuss with your management what changes can be made to move the 7 levers to improve profit, cash flow and business value:

- Price increase %

- Volume increase %

- COGS reduction %

- Overheads reduction %

- Reduction in Debtors Days

- Inventory / WIP – reduction in Stock Days

- Increase in Creditors Days

- Price increase %

Step 6: Rinse and repeat – review results and define new actions.